Userpilot was a powerful platform designed to optimise user engagement and satisfaction. Its tools enabled product teams to monitor behaviour, create tailored in-app experiences, and gather actionable insights through advanced analytics. By facilitating customer segmentation, survey collection, and feature tagging, it empowered teams to enhance user experiences and achieve business goals.

Userpilot was a powerful platform designed to optimise user engagement and satisfaction. Its tools enabled product teams to monitor behaviour, create tailored in-app experiences, and gather actionable insights through advanced analytics. By facilitating customer segmentation, survey collection, and feature tagging, it empowered teams to enhance user experiences and achieve business goals.

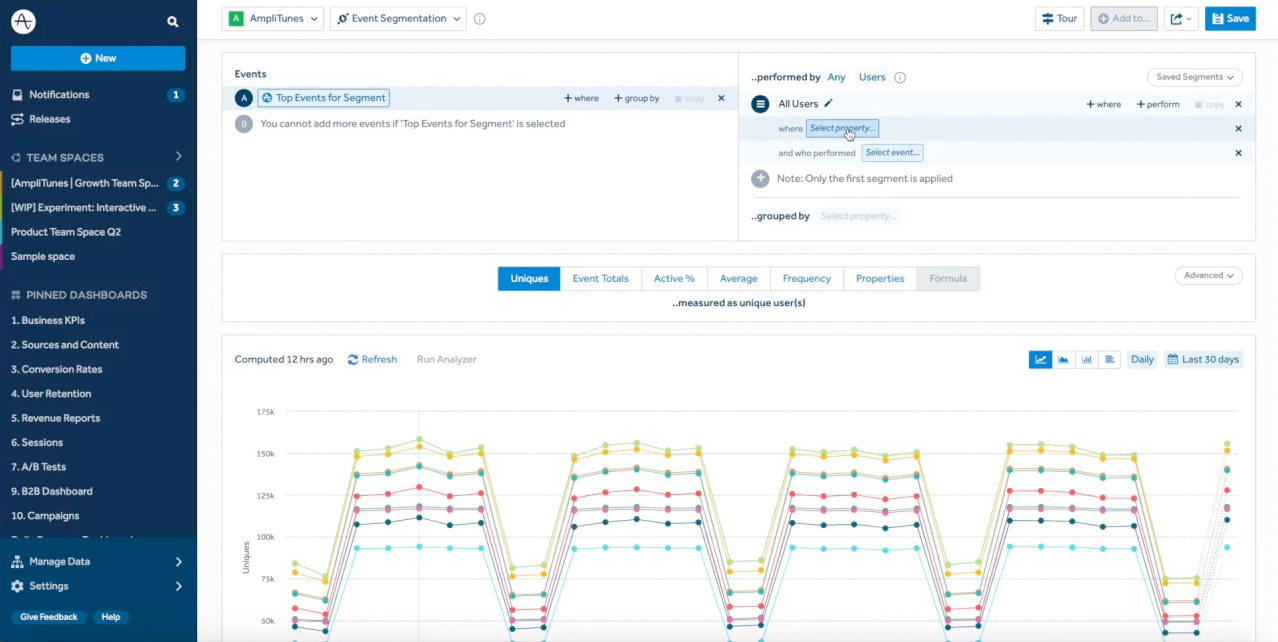

Amplitude was a leading digital analytics tool tailored for SaaS companies, providing deep insights into user behaviour. It enabled teams to track and segment user actions, offering customisable analytics to drive growth and optimise user experiences. Amplitude's robust features allowed product managers to make data-driven decisions, aligning product development with user needs.

Amplitude was a leading digital analytics tool tailored for SaaS companies, providing deep insights into user behaviour. It enabled teams to track and segment user actions, offering customisable analytics to drive growth and optimise user experiences. Amplitude's robust features allowed product managers to make data-driven decisions, aligning product development with user needs.

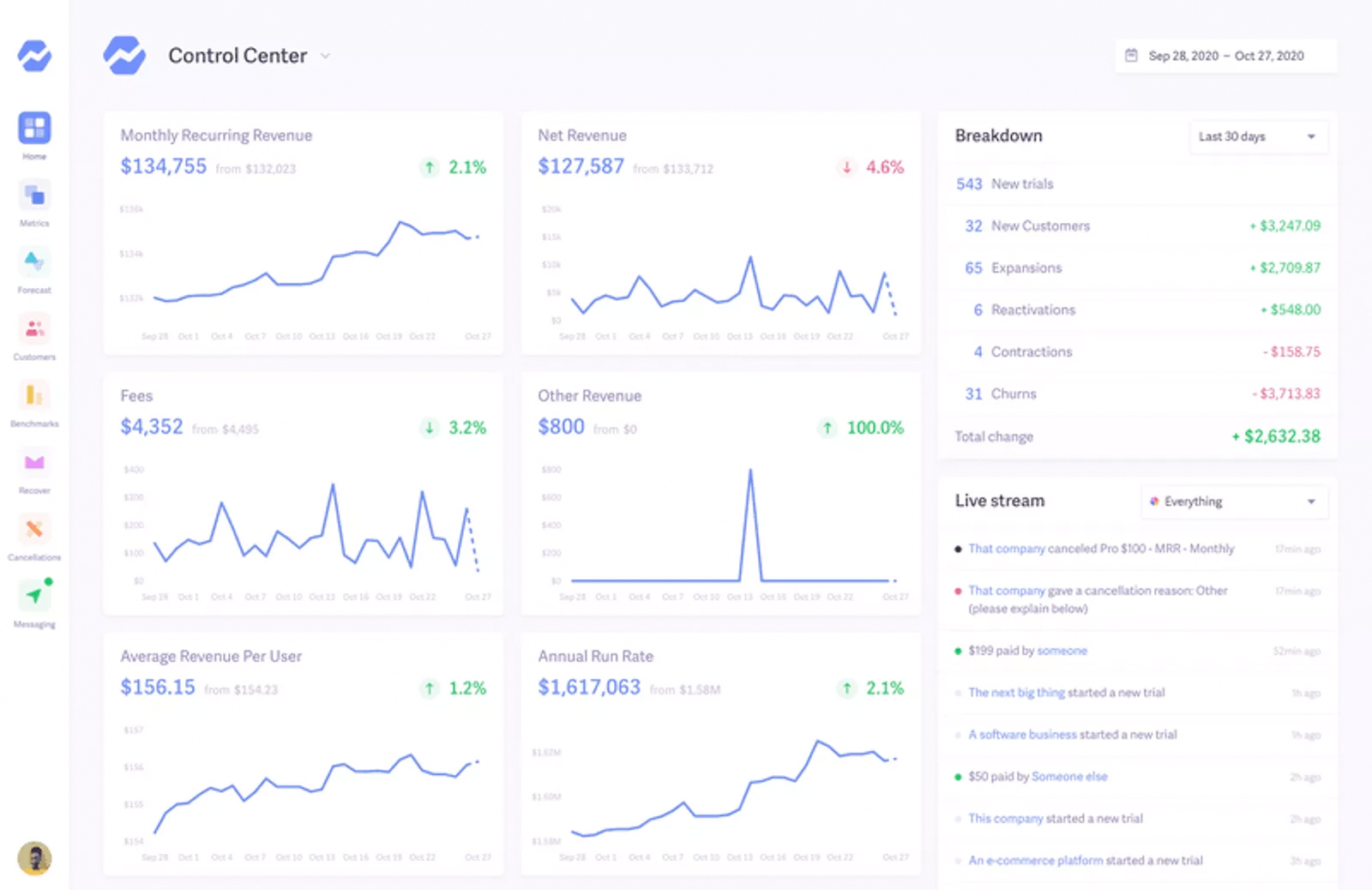

Baremetrics specialised in simplifying customer data analysis, offering a user-friendly platform for segmentation and growth monitoring. It catered to teams with straightforward needs, providing basic tools for categorising customers and assessing trends. While limited in advanced customisation, it remained ideal for teams prioritising simplicity over complexity.

Baremetrics specialised in simplifying customer data analysis, offering a user-friendly platform for segmentation and growth monitoring. It catered to teams with straightforward needs, providing basic tools for categorising customers and assessing trends. While limited in advanced customisation, it remained ideal for teams prioritising simplicity over complexity.

I just want a tool that helps me get things done without feeling like I have to figure it all out first. Clear labels and easy filters would save me so much time.

I need a system that works as fast as I do, so I can focus on leading my team and delivering results.

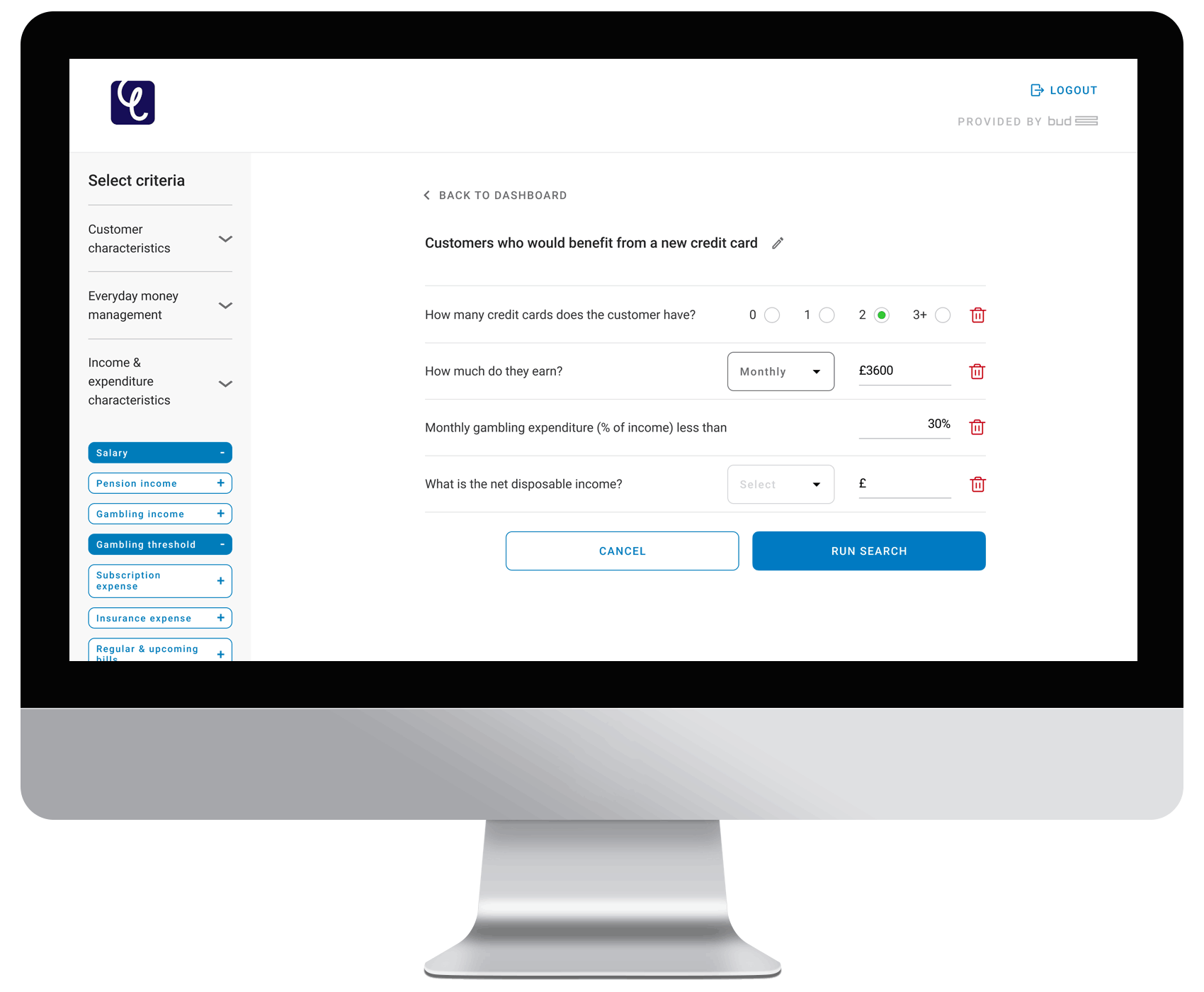

After finalising the initial wireframe sketches, a high-fidelity prototype was created in Figma, featuring all the major screens and core interactions to closely simulate the live app experience.

After finalising the initial wireframe sketches, a high-fidelity prototype was created in Figma, featuring all the major screens and core interactions to closely simulate the live app experience.