1. Introduction

Carbon tracking emerged as a top-requested feature from Bud’s customers, reflecting a strong demand for greener solutions in financial services. Bud’s goal was to meet this need by offering tools for users to monitor and reduce their environmental impact directly through the app.

Cogo and the Behavioural Insights Team conducted a survey of 2,007 UK mobile banking users to examine customer attitudes toward banks promoting eco-friendly behaviors (see source

here). Key findings from the survey included:

- High Interest in Carbon Tracking: 75% wanted insight into the carbon impact of their spending.

- Unmet Demand: Strong demand for green banking products in the UK market.

- Market Opportunity: 52 million retail customers are interested in eco-focused features.

- Competitive Differentiator: Sustainable banking rewards could help UK banks stand out.

- Transparency Matters: Customers want clarity on banks’ own carbon reduction efforts.

- Loyalty to Green Initiatives: 90% would favour companies that support environmental issues.

These insights confirmed a clear market opportunity for Bud to lead the way in sustainable finance by embedding carbon tracking directly into its platform.

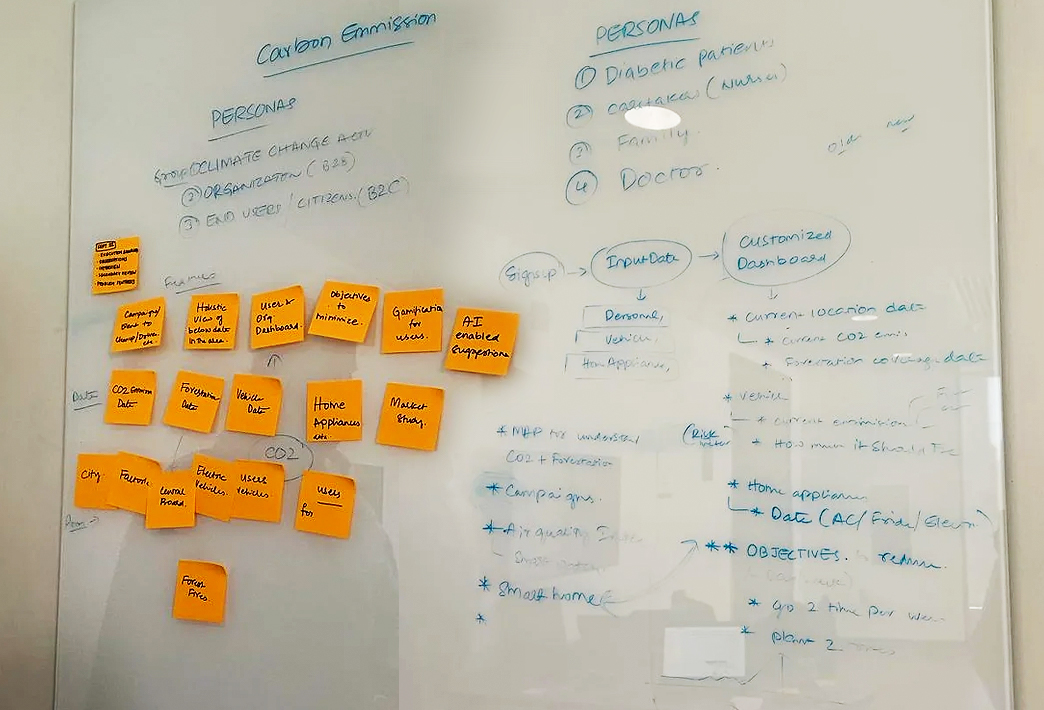

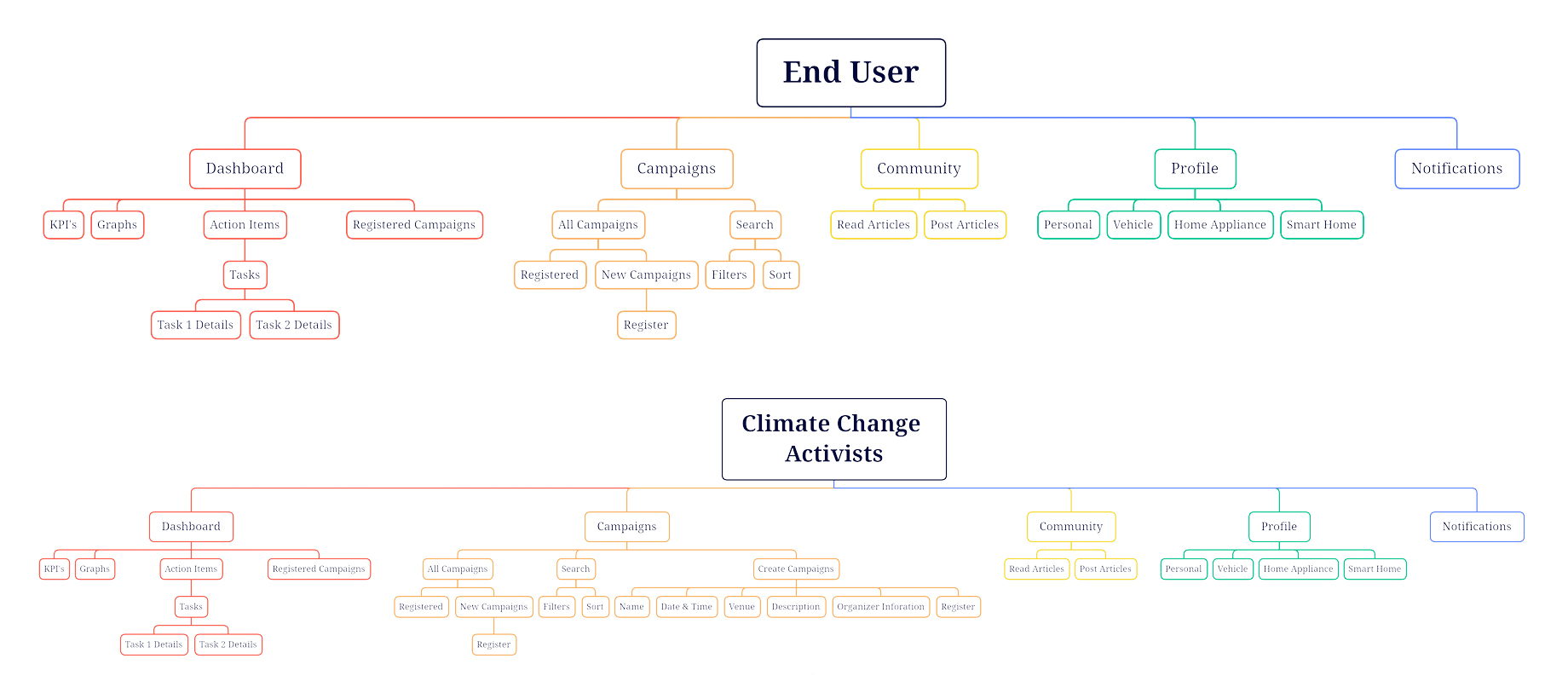

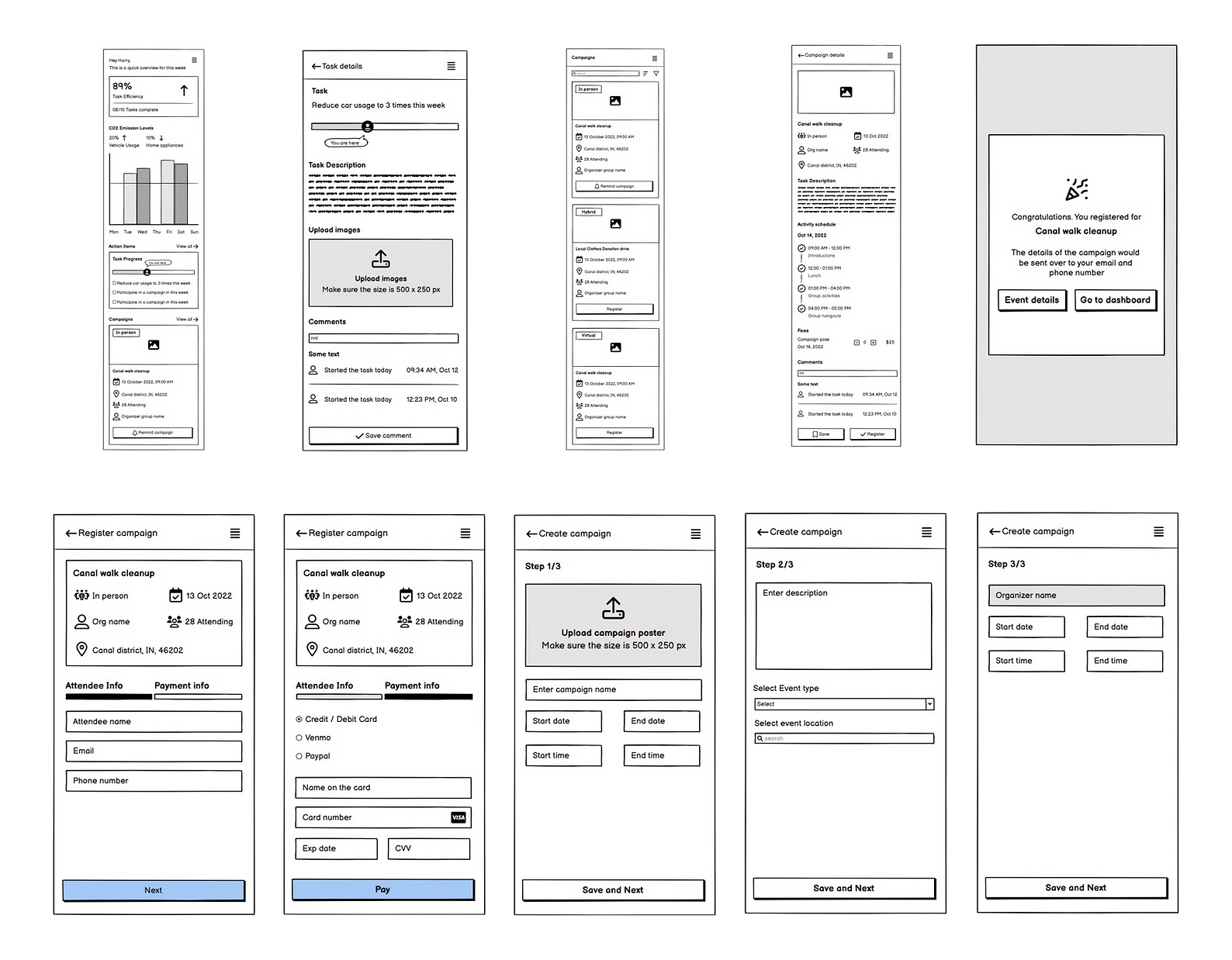

To define the product, it was essential to first identify user challenges. Research explored what users needed, why it mattered, and how the solution could meet their needs.

To define the product, it was essential to first identify user challenges. Research explored what users needed, why it mattered, and how the solution could meet their needs.